DIY Estate Planning Kit Ends Up Costing Religious Woman’s Estate Thousands of Dollars

November 10, 2017The Battle Over a War Hero’s Final Resting Place

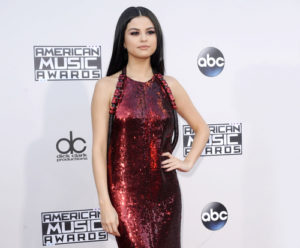

December 7, 2017Actress and pop star Selena Gomez revealed recently that she needed a kidney transplant because of her Lupus, and that her best friend – fellow actress Francia Raisa – stepped up to donate her own kidney. TMZ reported that Raisa wrote out her Will before undergoing the surgery, noting that it was at that moment she realized there was a chance she would not survive the procedure. Thankfully, everything seems to have gone well for both stars.

While nobody but Francia Raisa could tell you exactly what she was thinking when she created her Will, it’s a safe bet that she was encouraged to take that step by a friend or family member. At 29 years old and in seemingly good health, there probably wasn’t a reason for her to consider making a Will before agreeing to help her best friend in such a meaningful way.

By creating a Will, Raisa took an important step to make sure her assets will pass to the people and/or organizations that are most important to her, rather than leaving the distribution of her estate up to California law. She was also able to nominate someone to serve as her personal representative (executor), to carry out her wishes and settle her estate after she dies. This step can avoid a situation where surviving family members or friends argue amongst themselves about who should serve in that role.

Although she ultimately didn’t need her Will after the kidney transplant surgery, Raisa made a smart move by working on her estate plan now. Nobody knows what the future will bring, so it’s smart to prepare now.

Estate planning helps you manage and secure your assets while you are alive. Careful planning can save money on court costs and reduce the anxiety surrounding your estate so that you can enjoy your life and focus on your family. Proper planning can help lower or eliminate estate taxes and other expenses linked to inheritance, such as probate.

Estate planning services can include drafting advance health care directives, HIPPA Authorizations, durable powers of attorney, pour-over wills, guardianship nominations, community and separate property agreements, revocable living trusts, complex trust instruments, and guidance to properly title assets in trust title.

Our services are customized to your specific goals and will alleviate your unique concerns. Contact us today to get started!